You would typically find sub-limits on very low ticket size policies, but it’s always advisable to go for a health insurance plan that does not have sub-limits

source: http://www.livemint.com

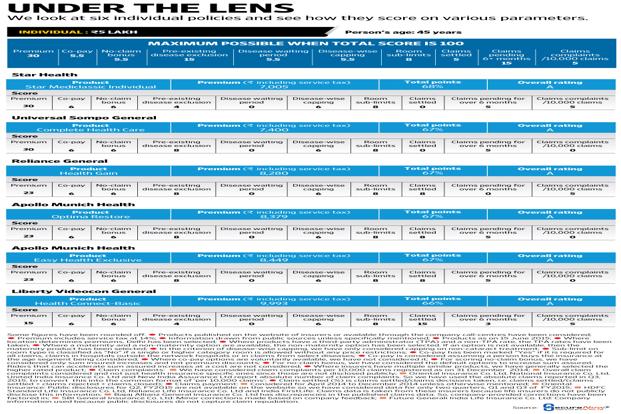

........ A health insurance policy packs in several features and caveats. To give you a ready comparison, we designed Mint Mediclaim Ratings (MMR), which was developed by SecureNow Insurance Broker Pvt. Ltd. The full ratings along with the methodology can be seen here: http://www.livemint.com/mintmediratings.

In the ratings, for family floater plans, we have considered two sum insured amounts (Rs.10 lakh and Rs.20 lakh) and three age categories in each—eldest insured member is 35, 45 or 65 years old.

For individual plans, the age categories are the same but the sum assured is Rs.5 lakh. The newest edition of the ratings (July 2015) also includes individual plans of Rs.5 lakh, Rs.10 lakh and Rs.20 lakh for a person aged 70 years.

This week, we spotlight individual policies with sum assured Rs.5 lakh, where the person is 45 years old.

.....

Let’s look at sub-limit on room rent. This means that your insurer would have decided the amount that it would pay towards hospital room rent. While some may describe this cap as a percentage of the sum insured, others may describe it as the category of room you would be eligible for. You need to be VERY VERY careful when buying a health insurance plan with sub-limit on room rents because usually other medical expenses are associated to the type of room you take and so you could end up paying the difference for not only the room rent but all other medical costs should you opt for a higher room category than allowed.

You would typically find sub-limits on very low ticket size policies, but it’s always advisable to go for a health insurance plan that does not have sub-limits. So, policies with no sub-limits get the highest score.

Key factors to consider before buying Health Insurance

(Source : www.bankbazaar.com)

Co-pay

Co-pay is a fixed percentage of the hospital bill you will have to pay when you make a claim, while the balance will be paid by the insurance company. For e.g. If your policy has a 10% Co-Pay clause, it means for a Rs 1,000 claim, you have to pay Rs 100 while the insurer will pay Rs 900. Ideally, opt for a "no co-pay" plan so you don't have to shell out for every claim.

Lifelong Renewable

The duration of coverage is the most important factor in buying a health insurance policy. Your health is most likely going to deteriorate only in your sunset years so ensure that your coverage is lifelong and not for a few years. Always go for a plan that can be renewed lifelong.

Waiting Period for Pre-existing Diseases

Pre-existing diseases are classified as diseases/conditions that a person has before buying health insurance. All pre-existing diseases aren't covered from day one of buying the policy. The time taken to cover pre-existing diseases will vary from plan to plan. Check the amount of time taken to cover pre-existing diseases in your plan.

Room Rent

Your room preference during hospitalization matters (such as shared room, private room or private room with high-end facilities). A costlier room means you'll pay higher treatment and hospitalization charges! It's better if your plan has a higher room rent limit per day.

64 comments:

Health insurance is one of the most essential thing of nowadays, how to have the best one? There is a perfect plan for it in this blog and it looks really helpful. Thanks a lot

Extremely thankful to you for sharing these best individual insurance plan up gradations. I thought lic jeevan anand returns are according to premium amount, however, my financial planner changed my perception and explained all.

Super Beitrag! Dies ist ein hilfreicher Beitrag. Dieser Artikel ist klar und enthält viele nützliche Informationen. Wir bieten die beste Krankenversicherung online. Um mehr zu erfahren, besuchen Sie unsere Website Pflegezusatzversicherung Vergleich

The post you have shared here about Health , is really informative as it contain some best knowledge which is very essential for me. Thanks for posting it. Keep it up. Medical Marijuana Doctors Online In Virginia

I got some wonderful knowledge from this post about Health . The post is very informative and contains some best knowledge. Thanks for sharing it. Mind Conditioning coach New York

Very informative article, which you have shared here about the Investment Plan Strategy. After reading your article I got very much information and it is very useful for us. I am thankful to you for sharing this article here.Investment Plan Strategy in Singapore

Thanks for giving such a good knowledge about Health. I got some helpful information from this post. Keep Posting such types of posts. anavar oxandrolone tablets

Thanks for sharing this article here about the dental insurance in charlotte. Your article is very informative and I will share it with my other friends as the information is really very useful. Keep sharing your excellent work.dental insurance in charlotte NC

I really appreciate this post, as the article you have shared here about the Health impression tray is really informative. Thanks for posting it. Keep Posting. Duromine For Sale Online In USA

Thank You for Sharing this informative post. You have clearly defined all the health insurance plans. Insurance is something that you must have for saving your family from any financial issues when you are not with them. I also have the best Texas Health Insurance plan provided by RBS Tax Services Houston.

I will share it with my other friends as the information is really very useful. Keep sharing your excellent work. Auto & Home Insurance Quotes Online Alberta

Excellent blog, good to see someone is posting quality information. Thanks for sharing this useful information. Keep up the good work korean makeup.

I have benefited greatly from reading what you have written about insurance requirements. I glad to read your article. We hope you will share more beautiful information with us. Thanks

Superr!! Education Counsellor Near Me | Study Mbbs In Kyrgyzstan

Great job, this is essential information that is shared by you. This information is meaningful and very important for us to increase our knowledge about it. Always keep sharing this type of information. Thanks once again for sharing it. Individual Insurance Plans in Hyderabad

Great article by the great author, it is very massive and informative but still preaches the way to sounds like that it has some beautiful thoughts described so I really appreciate this article. Best in home health care providers service provider.

It is truly a well-researched content and excellent wording. I got so engaged in this material that I couldn’t wait to read. I am impressed with your work and skill. Thanks. Consult doctors online

Hey what a brilliant post I have come across and believe me I have been searching out for this similar kind of post for past a week and hardly came across this. Thank you very much and will look for more postings from you Best Hr Solutions Minneapolis, Minnesota service provider.

I found decent information in your article. I am impressed with how nicely you described this subject, It is a gainful article for us. Thanks for share it. health insurance plans

Hey, What a post, I highly recommend your post anyone.

iot sim card

Among the service mentioned on the list, which one is the best?

Kegel Exercises

This is really a good source of information, I will often follow it to know more information and expand my knowledge, I think everyone should know it, thanks Best acheter cannabis sur internet service provider.

You have given essential data for us. about Insurance In Orlando Florida It is excellent and good for everyone. Keep posting always. I am very thankful to you.

I always check this type of advisory post and I found your article which is related to my interest.Financial Aid For Dental Care This is a great way to increase knowledge for us. Thanks for sharing an article like this.

It is truly a well-researched content and excellent wording. I got so engaged in this material that I couldn’t wait to read. Read more info about Insurance In Orlando Florida. I am impressed with your work and skill. Thanks.

I would like to say this is a well-informed article as we have seen here. Your way of writing is very impressive and also it is a beneficial article for us. Thanks for sharing an article like this.Medical Insurance Costa Rica

This blog is really helpful to deliver updated affairs over internet which is really appraisable. business interruption insurance

This is a very good tip especially to those new to the biosphere. Short but very accurate information… Many thanks for sharing this one. A must read the post!online cna program ca

It is really a helpful blog to find some different source to add my knowledge. business interruption insurance nz

Health insurance is something very important, there are many policies but you have to make sure which will benefit you. I find this blog very useful for my

Distance certificate course which I am doing from the distance learning center n Pune in the insurance field.

Beautiful post! Thank you for the information and tips! I love yoga and don't practice it half as much as I should.

Thank you for inspiring me and reigniting that flame

Stay wonderful!

The information you've provided is useful because it provides a wealth of knowledge that will be highly beneficial to me. Thank you for sharing that. Keep up the good work. How do I become a certified financial planner?

The information in the post you posted here is useful because it contains some of the best information available. Thanks for sharing it. Keep up the good work Allergist Westford Ma

I liked your work and, as a result, the manner you presented this content. It is a valuable paper for us. Thank you for sharing this storey with us. Allergist Westford Ma

this post very use full Skin ageing and its treatment

In Texas, the insurer is required to offer financial assistance in specific medical situations if you acquire a medical insurance plan. However, health insurance in Houston has an effect on your family, your finances, and your health. Knowing what you need and how it functions can make the difference between making expensive mistakes and having peace of mind.

exas, the insurer is required to offer financial assistance in specific medical situations if you acquire a medical insurance plan. However, health insurance in Houston has an effect on your family, your finances, and your health. Kn

fsafa

Medical Insurance Plans stands as a valuable asset in today's uncertain times, offering a layer of security and personalized care that goes beyond what public healthcare systems can provide.

Thank you for sharing your expertise and helping others make informed choices about their health coverage. I look forward to reading more of your insightful posts in the future. Rub-MD

Finding the best health insurance in Singapore is crucial for ensuring comprehensive coverage and peace of mind. It’s important to consider factors such as the extent of coverage for both inpatient and outpatient treatments, the network of hospitals and specialists available, and additional benefits like wellness programs or maternity care

Thanks for sharing the best information and suggestions, I love your content, and they are very nice and very useful to us. If you are looking for the best scooter insurance, then visit Insuremile. I appreciate the work you have put into this

Great amazing blog i like it.

Really enjoyed this post! Your perspective was refreshing and insightful. I learned a lot from your explanations. Can’t wait to read more of your work!Thanks. Read more info about Hockey Physio Langley

This article was so informative and easy to understand. You explained complex ideas simply and clearly. Thanks for sharing such valuable knowledge with your readers!Read more info about Tattoo enhancer

Excellent write-up! I appreciate the time and effort you put into this topic. Your tips are practical and inspiring. I’ll definitely be applying these ideas soon!Read more info about wave candy

A very informative post! It’s refreshing to see how small lifestyle changes can make a huge difference in overall health. Thanks for sharing such useful tips.Read more info about Childhood Trauma Counseling in Colony

This article provides such valuable insights into maintaining a healthy lifestyle. I especially liked the practical tips on balanced nutrition and stress management—simple yet powerful advice!Read more info about Refurbished Portable Oxygen Machine

A truly informative post! The section about building healthy habits was especially inspiring. Small, consistent changes really can make a big difference in long-term health.Read more info about Aaron Spitz Md

This article offers such insightful advice on maintaining daily wellness. I appreciate how it focuses on simple habits that truly make a long-term difference in health.Read more info about Art Therapy Sessions for Adults

This article provides valuable insights into maintaining a balanced lifestyle. I really appreciate the simple yet effective health tips shared here. Great work and very informative content!Read more info about Rent BiPAP Machine in Hyderabad

This insurance company offers reliable coverage with clear policies and helpful support. I appreciate how transparent they are about benefits and claims. Truly a trustworthy choice for long-term protection.Read more info about Cost For DUI in Texas

Great explanation on building financial stability! Your guidance makes managing expenses less stressful. This will definitely help beginners make better decisions with confidence.Read more info about Employee Benefits Hamilton

Excellent financial service that truly understands customer needs. Their guidance helped me make smarter decisions and plan my future with confidence. Highly recommended for anyone looking for reliable financial support.Read more info about Dozer Finance Melbourne

Medical marijuana offers promising relief for many conditions when used responsibly. It’s great to see more research and awareness helping patients find safer, plant-based treatment options.Read more info about medical marijuana doctors

Post a Comment